operating cash flow ratio negative

872 975. Negative cash flow is when your business has more outgoing than incoming money.

Cash Flow Coverage Ratios Aimcfo

Operating Cash Flow - OCF.

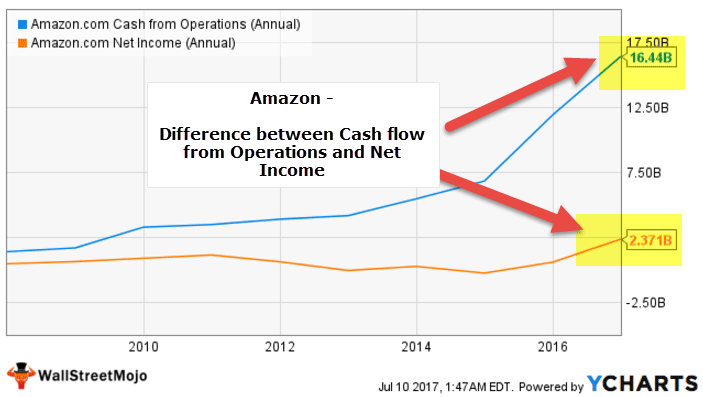

. Since the ratio is lower than 1 it indicates that Bower Technologies has a weak financial standing or is. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. Cash flow from operations can be found on a companys statement of cash flows.

Use these five tips to get your cash flow back into the green. Be mindful of your spending and investing. Cash Conversion Ratio CCR Operating cash flow EBITDA.

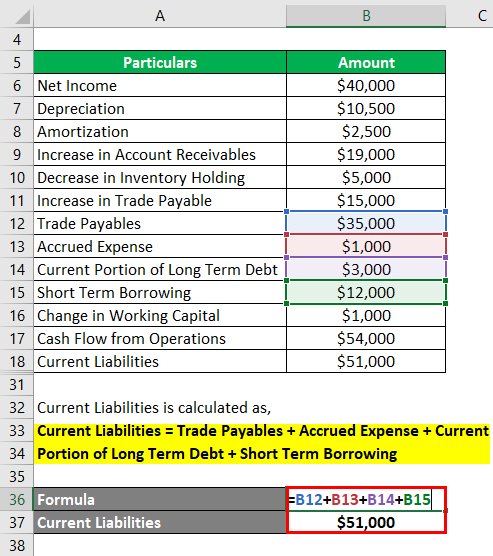

Dividing -50000 by 500000 to get -01 or -10. The operating cash flow ratio measures the ability of a business to pay for its current liabilities from its reported operating cash flows. Operating cash flow indicates.

Operating cash flow is a measure of the amount of cash generated by a companys normal business operations. What does a negative investing cash flow mean. You cannot cover your expenses from sales alone.

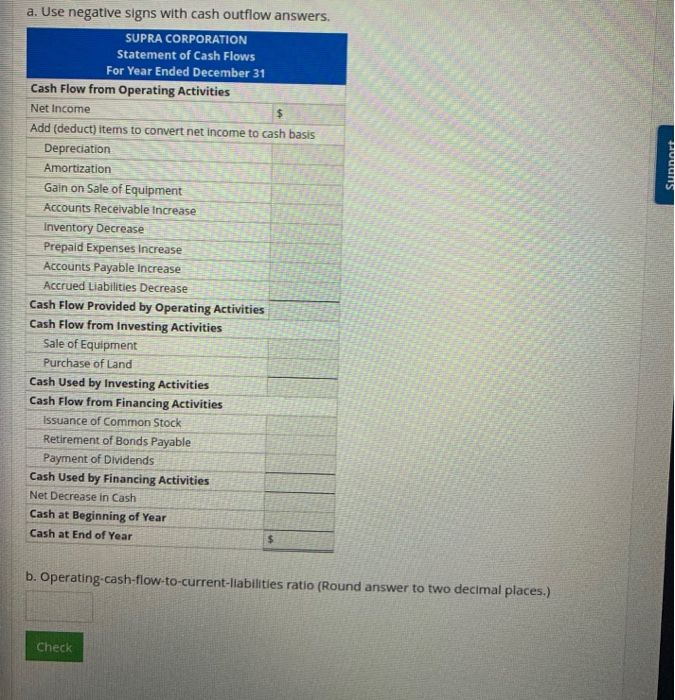

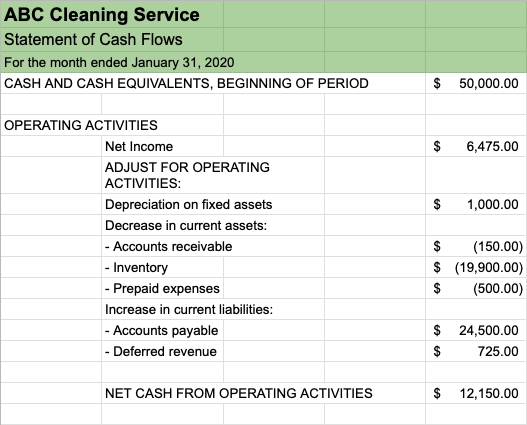

OCR Ratio Cash flow from operating activities Current liabilities. In the second scenario above because the operating profit is negative the profit margin percentage will be negative. Instead you need money from.

The formula for calculating the operating cash flow ratio is as follows. The best-case scenario is when the. A company might have a negative cash flow from investing activities because management is investing in long-term assets that should help the companys future growth.

When performing financial analysis operating cash flow should be used in conjunction with net income free cash flow FCF and other metrics to properly assess a. Negative cash flow is often indicative of a companys poor performance. Before splurging on new equipment software or employees weigh.

The operating cash flow ratio also known as a liquidity ratio is an indicator which helps to determine whether a company is able to repay its current liabilities with cash flow coming. Operating cash flows also known as cash flow from operations is a category in the cash flow statement and. However negative cash flow from investing.

Operating Cash Flow Margin. The Operating Cash Flow Ratio is a liquidity ratio its a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business operations.

Price To Cash Flow P Cf Formula And Ratio Calculation

Key Point To Consider For Cash Flow Analysis Presentation Graphics Presentation Powerpoint Example Slide Templates

Free Cash Flow Efinancemanagement

Cash Flow Formula How To Calculate Cash Flow With Examples

What Is Operating Cash Flow Ocf Definition Meaning Example

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

Corporate Cash Flow Understanding The Essentials

Change In Working Capital Video Tutorial W Excel Download

Net Cash Flow An Overview Sciencedirect Topics

Cash Flow Vs Net Income Key Differences Top Examples

How To Do A Cash Flow Analysis With Examples Lendingtree

What Is Negative Cash Flow How To Manage It

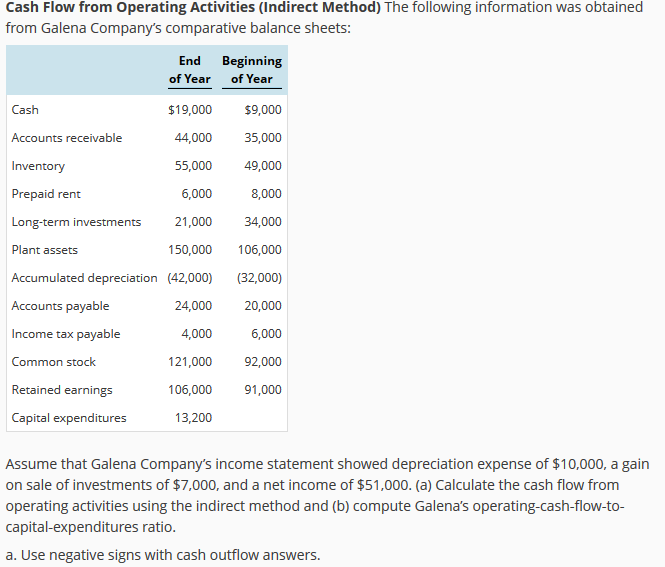

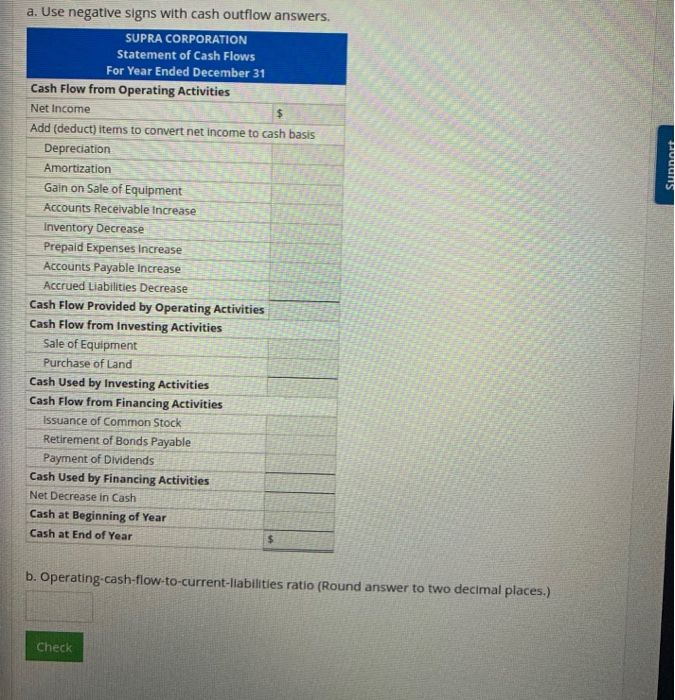

Solved Cash Flow From Operating Activities Indirect Method Chegg Com

What Does A Negative Operating Cash Flow Mean Cliffcore

Liquidity Ratio Formula And Calculation

What Can A Company Do If They Have Negative Cash Flow From Operations

Operating Cash Flow Ratio Youtube

Paired Sample T Test Of Operating Cash Flow Ratios Before And After M A Download Table

Solved Question 2 Not Complete Marked Out Of 5 00 P Flag Chegg Com