stock option sale tax calculator

January 29 2022. The Employee Stock Options Calculator For use with Non-Qualified Stock Option Plans.

W4 Calculator Software For Tax Professionals

The Stock Option Plan specifies the employees or class of employees eligible to receive options.

. On this page is a non-qualified stock option or NSO calculator. Depending on your holding period of the stock the capital gain or. Nso Stock Option Tax Calculator.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your. Please enter your option information below to see your potential savings. This online calculator will calculate the exact amount of tax that you owe considering all the factors mentioned above.

Nonqualified Stock Options NSOs are common at both start-ups and well established companies. Ordinary income tax and capital gains tax. Click to follow the link and save it to your Favorites so.

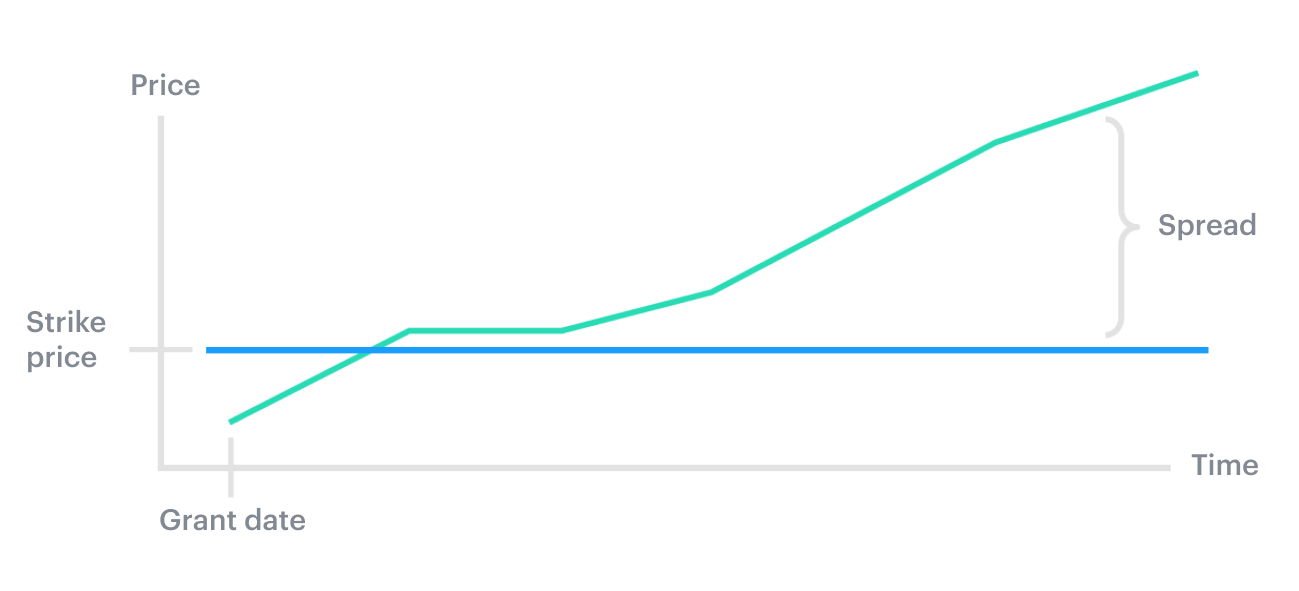

First the gain in value of stock is taxed at different rates. The underlying stock price must exceed the strike. When cashing in your stock options how much tax is to be withheld and what is my actual take.

The strike price is the stock price that your options were issued at. How Does Stock Tax Calculator Work First of all you provide the. Cost of capital of shares value per share at exit.

In our continuing example your theoretical gain is. Nonqualified Stock Option NSO Tax Calculator. Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO.

This permalink creates a unique url for this online calculator with your saved information. Capital Gains Tax Calculator. Youve made a 81 net.

How much are your stock options worth. The Stock Option Plan specifies the total number of shares in the option pool. Enter the number of shares purchased.

The tool will estimate how much tax youll pay plus your total return on your. This calculator lets you estimate how much it will cost you to exercise your options or will help you compute the gain in a given exercise and sale scenario. Youre basing your investing strategy not on long-term considerations and diversification but on a short-term tax cut.

The amount you received for writing the option increases the amount received from the sale of the stock. Build Your Future With a Firm that has 85 Years of Investment Experience. The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37.

And if you re-purchase the stock. For this calculator the current stock price is assumed to be the strike price. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

You make a 147 pre-tax gain on each ISO you sell 150 3 strike price For each sold ISO you owe 6615 in ordinary taxes 147 45 Your net gain is 8085 per ISO. Use the employee stock option calculator to estimate the after-tax value of non-qualified stock options before cashing them in. There are two types of taxes you need to keep in mind when exercising options.

On this page is an Incentive Stock Options or ISO calculator. Non-qualified Stock Option Inputs.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

2022 Capital Gains Tax Calculator Personal Capital

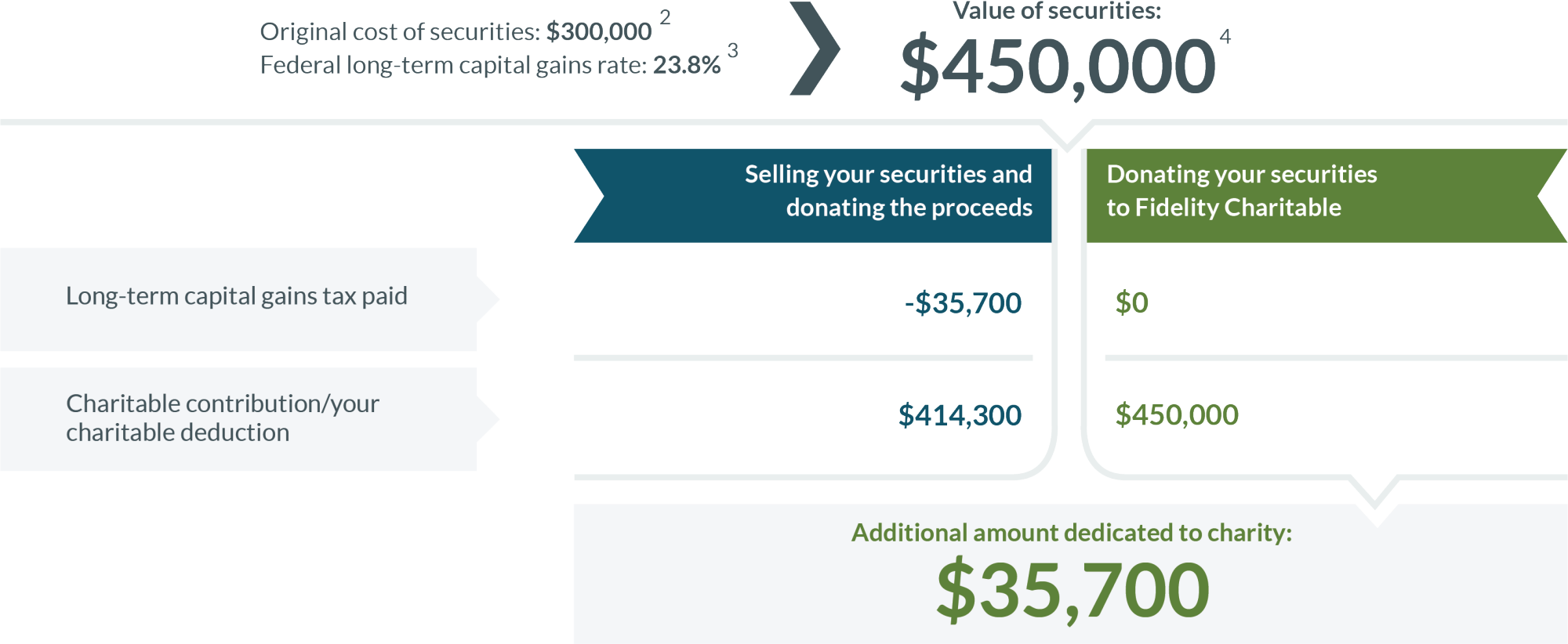

Donating Stock To Charity Fidelity Charitable

Guide To Nonstatutory Stock Options Nsos Personal Capital

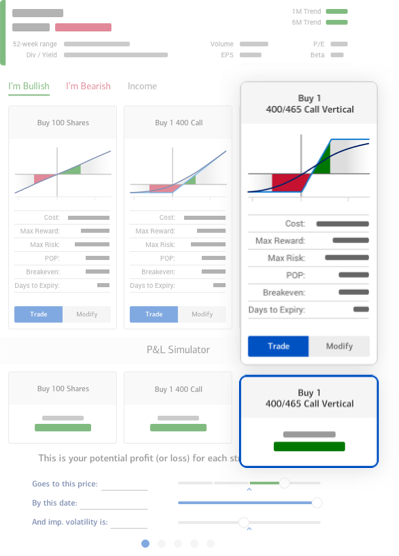

Know The Strategies When It Comes To Taxes On Options Ticker Tape

How To Assess Your Incentive Stock Option Iso Strategy

Sales Tax Calculator Double Entry Bookkeeping

Incentive Stock Option Iso Calculator Dqydj

What Is A Disqualifying Disposition With Incentive Stock Options What Can Cause It And Why Does My Company Care Mystockoptions Com

Understanding Employee Stock Purchase Plans E Trade

What Are Incentive Stock Options Isos Carta

Understanding The Tax Implications Of Stock Trading Ally

How To Calculate Iso Alternative Minimum Tax Amt 2021

How Are Options Taxed Charles Schwab

How To Calculate Sales Tax On Almost Anything You Buy

The Best Sales Tax Software Of 2022 Digital Com

Options Trading Online With Merrill Edge Self Directed Investing