michigan use tax exemption form

Sales Use and Withholding Tax Due Dates for Holidays and Weekends. Ad File the Online Form 2290 For Vehicles Weighing 55000 Pounds or More.

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Ad Fill Sign Email MI DoT 3372 More Fillable Forms Register and Subscribe Now.

. If the taxpayer inserts a zero on or leaves lines 5a - 5l to deduct from gross sales the nontaxable sales blank any line reporting sales tax use tax or withholding. Ad File the Online Form 2290 For Vehicles Weighing 55000 Pounds or More. Purchasers may use this form to claim exemptlon from Michigan sales and use tax on.

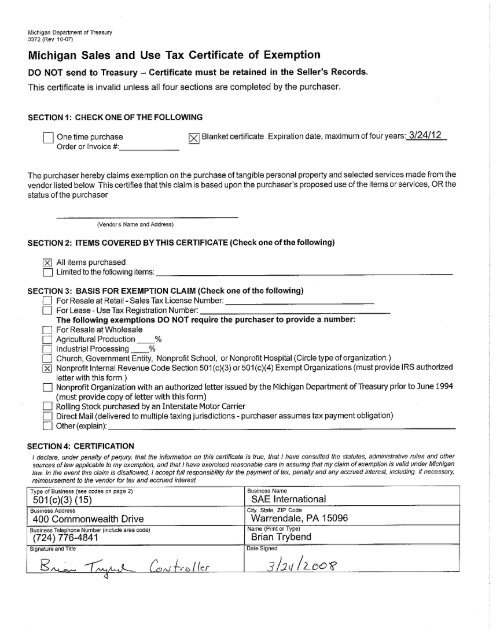

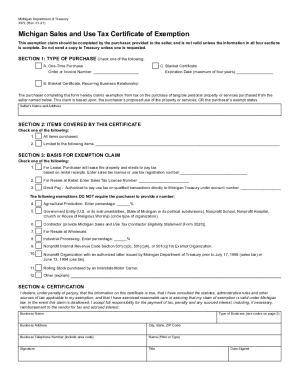

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on. Michigan Department of Treasury Form 3372 Rev. Department of Public Works.

Michigan Sales and Use Tax Exemption Certificate. Sales Tax Return for Special Events. A Michigan resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to.

File Your IRS 2290 Form Online. Sales Tax Return for Special Events. Certifi cate must be retained.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on. Michigan Use Tax Form. Certiicate must be retained in the.

Sales Tax Return for Special Events. DO NOT send to. Ad MI Hardship Program More Fillable Forms Register and Subscribe Now.

Civil Rights Inclusion Opportunity Department. Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied. The following exemptions DO NOT require the purchaser to provide a number.

Buildings Safety Engineering and Environmental Department. This exemption application must be completed by the buyer provided to the seller and is not valid unless the information in all four. Opry Mills Breakfast Restaurants.

Michigan Sales and Use Tax Certificate of Exemption. 2017 Sales Use and Withholding MonthlyQuarterly and Amended MonthlyQuarterly Worksheet. Instructions for completing michigan sales and use tax certicate of exemption form 3372 purchasers may use this form to claim exemption from michigan sales and use.

08-12 Michigan Sales and Use Tax Certifi cate of Exemption DO NOT send to the Department of Treasury. Michigan Department of Treasury Form 3372 Rev. In order to claim exemption the nonprofit organization must provide the seller with both.

11-09 Michigan Sales and Use Tax Certificate of Exemption. Steps for filling out the Michigan Sales and Use Tax Certificate Exemption Form 3372 Step 1 Begin by downloading the Michigan Resale Certificate Form 3372 Step 2. Michigan Sales and Use Tax Contractor Eligibility Statement.

Ad The Semiconductor Lifecycle Solution the worlds largest source of semiconductors. The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form. Church Government Entity Nonprofit School or.

SOM - State of Michigan. 8-09 Michigan Sales and Use Tax Certiicate of Exemption DO NOT send to the Department of Treasury. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption Evidence of.

Restaurants In Matthews Nc That Deliver. We offer a broad product selection value added services manufacturing solutions. MI Hardship Program More Fillable Forms Register and Subscribe Now.

File Your IRS 2290 Form Online. Keller Is an IRS Approved e-File Provider. Use or withholding tax.

Keller Is an IRS Approved e-File Provider. Michigan Sales and Use Tax Certificate of Exemption. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption.

Sales Use and Withholding Tax Due Dates for Holidays and Weekends. Michigan Sales and Use Tax Certificate of Exemption. 2017 Sales Use and Withholding Payment Voucher.

Michigan Department of Treasury Form 3372 Rev. 3372 Michigan Sales and Use Tax Certificate of Exemption.

Sales Tax License Michigan Fill Online Printable Fillable Blank Pdffiller

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Michigan Sales Use And Withholding Taxes Annual Return Fill Online Printable Fillable Blank Pdffiller

How To Start A Nonprofit Step By Step

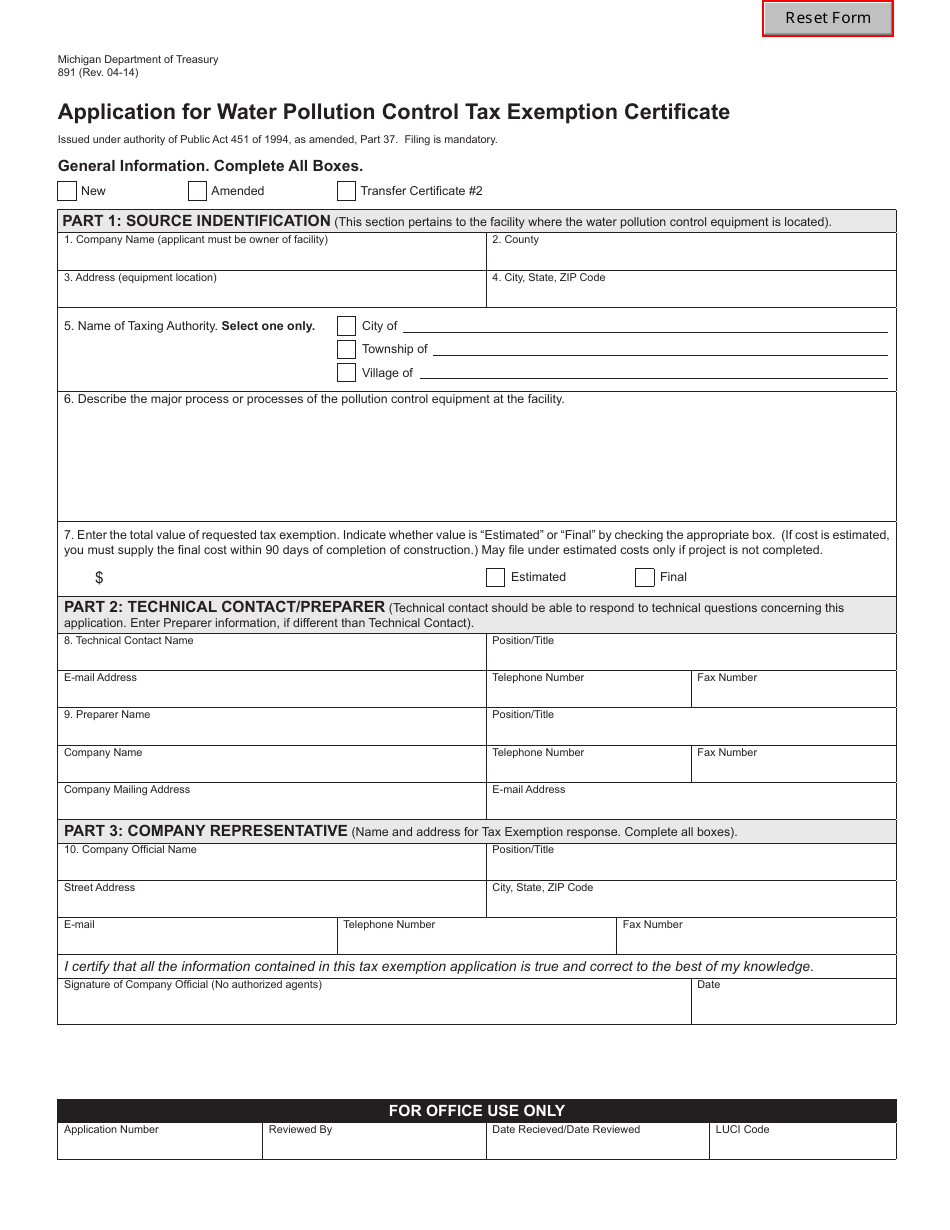

Form 891 Download Fillable Pdf Or Fill Online Application For Water Pollution Control Tax Exemption Certificate Michigan Templateroller

Michigan Sales And Use Tax Certificate Of Exemption

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

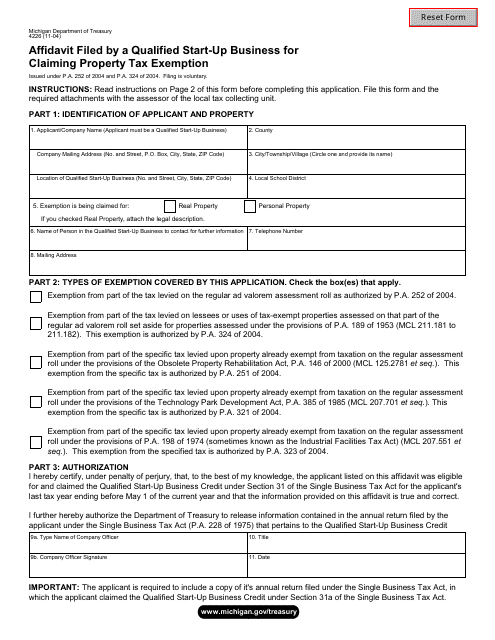

Form 4226 Download Fillable Pdf Or Fill Online Affidavit Filed By A Qualified Start Up Business For Claiming Property Tax Exemption Michigan Templateroller

Get And Sign Form 3372 Michigan Sales And Use Tax Certificate Of 2021 2022

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller